What Does Additional Borrowing Mean

How does the library contact me with information about my account collapsed. Borrow To receive money from another party with the agreement that the money will be repaid.

Same Day Car Loans Will Definitely Help The Loan Seekers To Get Additional Money For Buying A New Car With Cash Loans No Credit Check Loans No Credit Loans

Companies that regularly work with others may need to provide additional insured status in many situations and it would be.

What does additional borrowing mean. Anytime you add on to your overall debt burden you make yourself more vulnerable in case you then experience financial difficulties that affect your ability to repay your debts. The additional loan would be linked to your property which you could lose if you werent able to keep up your extra loan payments. Even though interest rates on mortgages are normally lower than rates on personal loans and much lower than credit cards.

Most borrowers borrow at interest meaning they pay a certain percentage of the principal amount to the lender as compensation for borrowing. The additional amount youre borrowing is a separate secured loan thats linked to your mortgage. This is an option if youre looking to pay for some major home improvements or to raise a deposit to buy a second home for example.

How much does it cost to borrow a WiFi hotspot collapsed. Does not exceed 90 of the value of your home and that you can afford this amount of borrowing. We help weigh up the considerations as you decide whats best for you.

Its a service that people want too - because theres a much larger number of people that want to lend short than borrow short and conversely theres a much larger number of. The appropriation of ideas or words etc from another source. In subtraction regrouping means that you borrow 10 from the next column to.

What does additional processing mean collapsed. BORROWING used as a noun is rare. This means that if the number being subtracted is greater than the number its being subtracted from you must regroup.

Borrowing Base Availability means on any date the Borrowing Base calculated in the most recent Borrowing Base Certificate delivered pursuant to Section 61iv or 24Aiiib as of such date minus the Borrowing Base Debt on such dateprovided that in the case of any Borrowing Base Certificate delivered pursuant to clause c of Section 61iv the Borrowing Base calculated therein. How long will I have to wait for my Arts book. Blanket additional insured endorsements extend liability insurance coverage to multiple additional insureds without requiring the policyholder to individually name each party.

To adopt a word from one language for use in another. Outstanding Borrowings means with respect to any Other Secured Loans the sum without duplication of a the outstanding principal amount of all loans and other extensions of credit including without limitation the aggregate undrawn amount and all unreimbursed draws under any issued and outstanding letters of credit made to or for the account of the Co-Issuers under the Other Secured Loan Agreements. Additional borrowing against the value of your property sometimes referred to as a further advance is possible if you have a certain amount of equity in the property.

What does blanket additional insured mean. Most loans also have a maturity date by which time the borrower must have repaid the loan. It increases government borrowing s and sends it into an interest repayment cycle which only further increases spending in the future.

If you dont want to borrow it all back eligibility applies or remove the overpayment reserve youll need to ensure your. Borrowing more from your mortgage lender You can get a further advance on your mortgage where you borrow an additional amount of money against your home from your current mortgage lender. What does borrow mean.

By taking out a second mortgage you are adding to your overall debt burden. This means the increase in cash flow came from borrowing money not from increased sales. Obtaining funds from a lender.

However decreased net borrowing could indicate a strong financial position by decreasing the amount of debt. If cash flow has increased but net borrowings has increased more than cash flow then it could mean a company is in a poor financial position.

What Is Finance Definition Overview Types Of Finance

.jpg)

Is Borrowing On Your Mortgage The Best Way To Finance Home Improvements

What Is Regrouping In Math Definition Subtraction Addition Video Lesson Transcript Study Com

Can You Own Another Property And Apply For A Usda Loan

Enterprise Value Vs Equity Value Is Commonly Misunderstood Wall Street Prep

9 Money Mistakes To Avoid Oak Tree Business Systems Inc Provides Compliant Forms And Disclosures To Credit Union Money Strategy Money Plan Show Me The Money

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

A Good Personal Debt Combination Could Mean Different Benefits Financial Advantages The Most Useful Of Them I Debt Debt Consolidation Loans Debt Consolidation

Https Www Jstor Org Stable 43189379

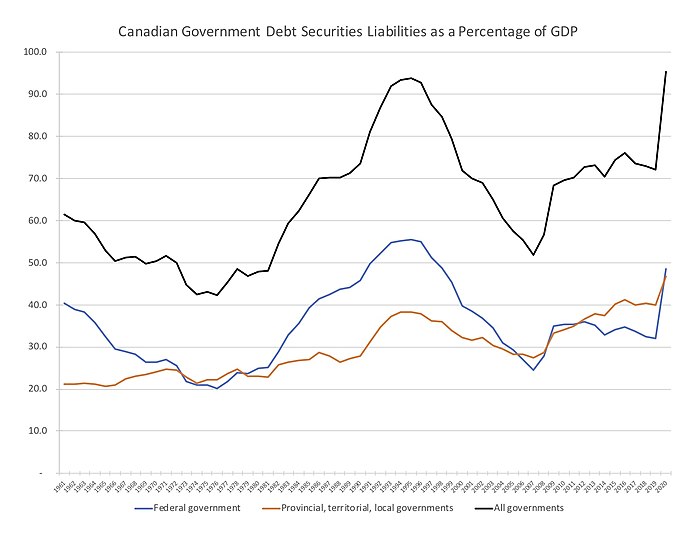

Canadian Public Debt Wikipedia

Should You Consider Adding Co Borrower To Your Mortgage

How To Get A Loan With Excellent Credit Credit Score Above 740

Urgent Cash Loans Scheme Are Help To The Borrowers To Get Monetary Assistance Without Undergoing Complicated Pape Payday Loans Unsecured Loans Short Term Loans

Borrowing Definition And Meaning Collins English Dictionary

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

Don T Assume That Borrowing Lots Of Money Can Make Your Startup Fly The Borrowers Start Up Lots Of Money

/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Bond Definition Understanding What A Bond Is

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)